1500 paycheck after taxes

The capital loss deduction limit is 1500 each when filing separately instead of 3000 on a joint return. 6 to 30 characters long.

Paystub Calculator Check Stub Maker

The correct withholding from the tables is 78.

. Paycheck advance loans used to be risky propositions. In the 22 tax bracket that would mean an income tax savings of 330. Your paycheck needs protection.

You dont owe taxes on side hustles. Your service fees will be adjusted accordingly. The other sales tax holiday is the Show-Me Green holiday.

Using Worksheet 3 and the withholding tables in section 3 of Pub. The larger the paycheck. In order to avoid having any taxes withheld.

For example 3000 in self-employment tax reduces your taxable income by 1500. Hourly Paycheck Calculator Enter up to six different hourly rates. Historically the most common work schedule for employees across the United States is an 8-hour day with 5-days per week.

If a capital loss exceeds the 3000 deduction you can carry over the excess amount. 25 an hour is 2000 biweekly before taxes and approximately 1500 after taxes. 2022 W-4 Help for Sections 2 3 and 4.

Computer software up to 350 and personal computers up to 1500. If filed after March 31 2022 you will be charged. Before sharing sensitive information make sure youre on a federal government site.

Filing Taxes 2022 Back to School Finances GEN Z. 4 Without ITC I would have to send IRS 500 difference 5 with ITC I would a get a refund from the IRS of the 5000 withheld from my paycheck b I wouldnt owe them 500 c I would have 1500 left to apply to next years liability. That can be a huge win for parents of kids under 13 14 in 2021 due to special rules for coronavirus because before- and after-school care day care preschool and day camps usually are allowed.

Federal government websites often end in gov or mil. A cash advance loan from a local payday lender often included sky-high interest rates and a repayment window of two weeks to 30 days. The gov means its official.

Income After Taxes. Joe Manchin and Chuck Schumer craft a scaled-back version of the economic package thwarted by Manchin last year. Must contain at least 4 different symbols.

Forgiveness of Paycheck Protection Program PPP loans. And global markets with our market summary page. Salary Paycheck Calculator How much are your wages after taxes.

Paying a tax rate of 25 and working full-time at 40 hours a week you would earn 1500 after taxes. For amounts incurred or paid after 2017 the 50. You can deduct up to 3000 of a capital loss per year or 1500 if your filing status is married filing separately from your taxable income.

How they determine your taxes. SmartAssets Georgia paycheck calculator shows your hourly and salary income after federal state and local taxes. Calculate your paycheck withholdings for free.

Taxes can really put a dent in your paycheck. How to calculate taxes taken out of a paycheck. Working 10 hours a.

Dems propose raising taxes on high earners to preserve Medicare Sens. Referring client will receive a 20 gift card for each valid new client referred limit two. ASCII characters only characters found on a standard US keyboard.

Under this method you claim your allowable mortgage interest real estate taxes and casualty losses on the home as itemized deductions on Schedule A Form 1040. Citizen or permanent resident provide proof of earned wages of at least 1000 per month after taxes have a bank account in. Resident for tax purposes until you notify the Secretary of Homeland Security and file Form 8854.

It applies to certain Energy. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Check out these deals below.

Referred client must have taxes prepared by 4102018. Stay on top of the changing US. Free Federal and Minnesota Paycheck Withholding Calculator.

Income After Taxes. Termination of residency after June 3 2004 and before June 17 2008. Check to claim a spouse deduction.

If you terminated your residency after June 3 2004 and before June 17 2008 you will still be considered a US. The rate at which federal taxes are withheld from your paycheck depends on the information you provide on your Form W-4. In February he receives salary of 1000 plus a commission of 500 which you combine with regular wages and dont separately identify.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an HR Block or Block Advisors office and paid for that tax preparation. Be 18 years or older a US.

For example say you only decided to work a couple of shifts and ended up working a total of 10 hours in a week. 3 I had 5000 withheld from my paycheck for federal taxes year. Number of dependents other than you and spouse you claim.

Dive deeper with our rich data rate tables and tools. But with a Savings or CD account you can let your money work for you. 15-T you withhold 29 from this amount.

You figure the withholding based on the total of 1500. With TurboTax you can be confident your taxes are done right from simple to complex tax returns no matter what your situation. Enter your info to see your take home pay.

Itemized Taxes Paid Itemized. This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. You can claim an allowance if you spend at least 1500 per year in out-of-pocket child care expenses as long as you intend to claim a credit for this on your income tax return.

The deduction under the optional method is limited to 1500 per year based on 5 per square foot for up to 300 square feet. The Future of Finances. The forgiveness of a PPP loan creates tax-exempt income so you dont need to report the income on Form 1040 or 1040-SR but you do need to report certain information related to your PPP loan.

If you work 40 hours a week then converting your hourly wage into the weekly equivalent is easy as you would simply multiply it by 40 which means adding a zero behind the hourly rate then multiplying that number by 4. Write-in taxes including uncollected social security and Medicare or RRTA tax on tips you. This is an estimated quarterly taxes myth because the IRS requires you to pay taxes on all sources of income unless theyre specifically excluded.

Taxes can really put a dent in your paycheck. Check if single or married and family has only one job or a second job has annual income of less than 1500. But with a Savings or CD account you can let your money work for you.

2022 Federal State Payroll Tax Rates For Employers

Employer Cannot Profit From Unclaimed Employee Paychecks Wage Hour Defense Blog Printable Checks Payroll Checks Payroll Template

The Pros And Cons Biweekly Vs Semimonthly Payroll

K33w4ljb410vgm

New York Hourly Paycheck Calculator Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

This Is What A Server S Paycheck Looks Like For Waffle House R Wafflehouse

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

Paycheck Tax Withholding Calculator For W 4 Tax Planning

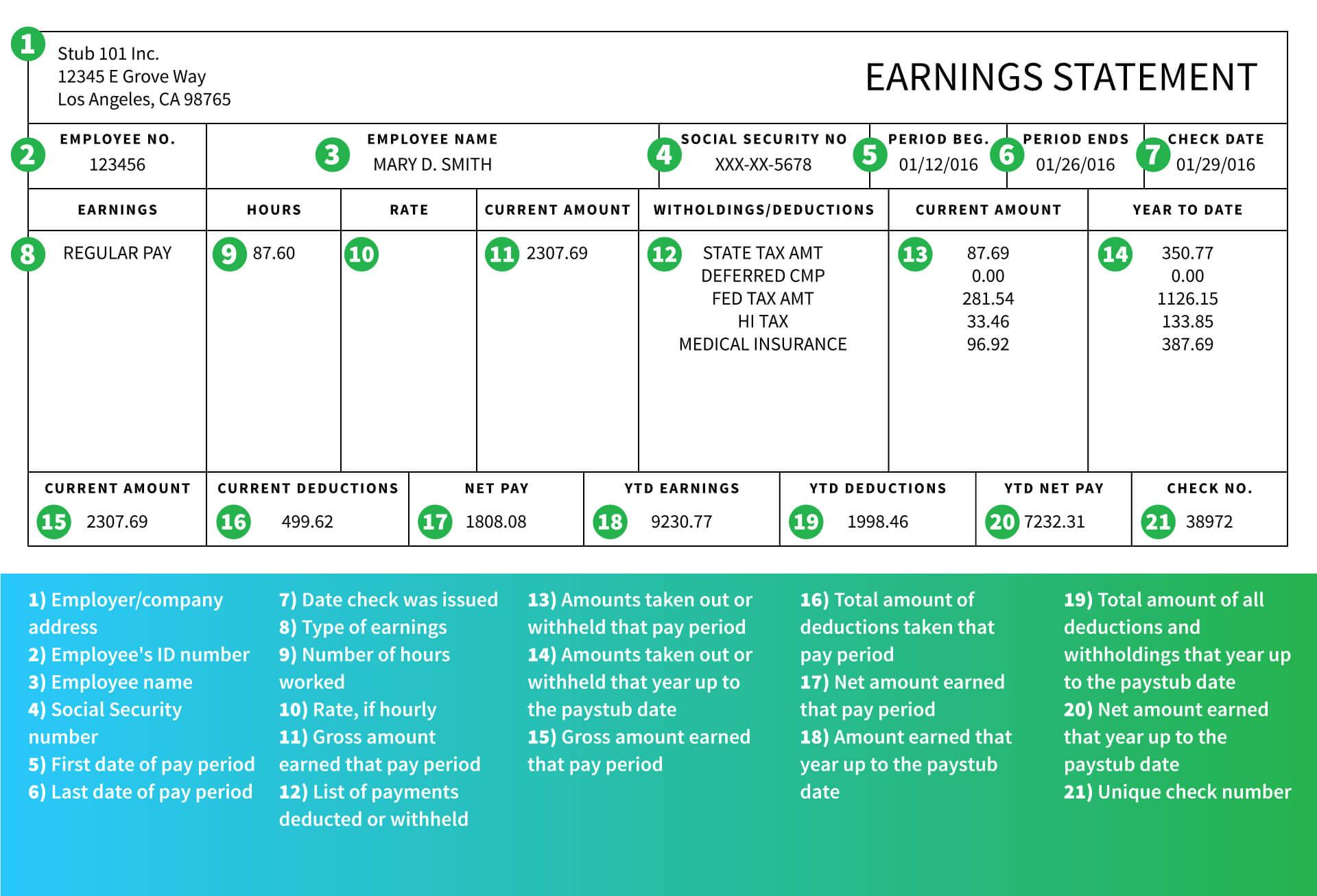

How To Read A Pay Stub Gobankingrates

How To Calculate Net Pay Step By Step Example

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Florida Paycheck Calculator Smartasset

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator